Our I need confirmation my bankruptcy has ended PDFs

The Ultimate Guide To Application for Discharge of Judgment

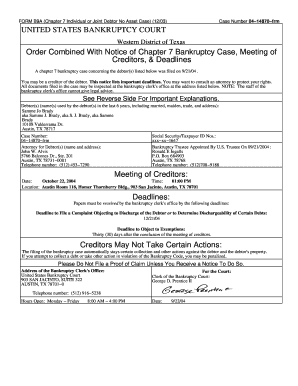

Lots of people desire to get a copy of their personal bankruptcy discharge papers and other insolvency documents, and there are lots of reasons. Possibly you require your total personal bankruptcy declare your records, or you're looking to make an application for a brand-new task and require a copy of your discharge papers. Frequently a debtor will require access to their personal bankruptcy records to correct their credit report after their case is discharged.

Bankruptcy: How to get a certificate of discharge - Official Receiver's Office

It is necessary to keep a copy of your personal bankruptcy case. Talk with Learn More Here for legal guidance post-discharge. Getting legal suggestions from an knowledgeable personal bankruptcy lawyer is always crucial. In addition, they can examine your case file if concerns emerge after discharge. A personal bankruptcy legal representative can help you get personal bankruptcy records for you records and future use.

Free Bankruptcy Explanation Letter Templates and Samples - Download PDF & Print - Templateroller

Having a copy of your insolvency records can be really helpful in case you get taken legal action against on a debt that needs to be discharged or need to challenge a discharged debt with the credit reporting agencies. Tabulation An insolvency discharge order releases the debtor from personal liability for various kinds of debt.

A lender can not gather upon a financial obligation when the bankruptcy court discharges it in either a chapter 7 insolvency or a chapter 13 personal bankruptcy. For this reason it is very important to keep a copy of your bankruptcy discharge. If you lost or lost your copy you ought to attempt to get a copy of your personal bankruptcy records.

Fascination About How Do You Prove a Bankruptcy Discharge to an Auto Lender?

Frequently when there are errors on a credit report. Credit reporting firm requirements frequently need a copy of the discharge to make necessary modifications. When the insolvency court problems a discharge order for unsecured debt, many if not all credit card debt, medical debt, and other unsecured types of financial obligation can no longer be collected upon by your lenders.

A debtor will wish to maintain evidence of their insolvency filing if a credit looks for to gather on an unsecured debt after the insolvency is completed. Your personal bankruptcy records will include all of the lenders you owed cash to. It will likewise consist of a copy of your discharge order. Secured creditors are dealt with in a different way after a discharge order is provided.